How to Calculate And Interpret The Current Ratio Bench Accounting

It is worth knowing that the current ratio is simpler to calculate, but sometimes it is less helpful than the quick ratio because it doesn’t make a distinction between the liquidity of different types of assets. In the dynamic world of finance, it’s essential to navigate the complexities of financial ratios. Today, we unravel the ‘Current Ratio,’ a key metric used to assess a company’s financial health. The first way to express the current ratio is to express it as a proportion (i.e., current liabilities to current assets). The company has just enough current assets to pay off its liabilities on its balance sheet. In this example, although both companies seem similar, Company B is likely in a more liquid and solvent position.

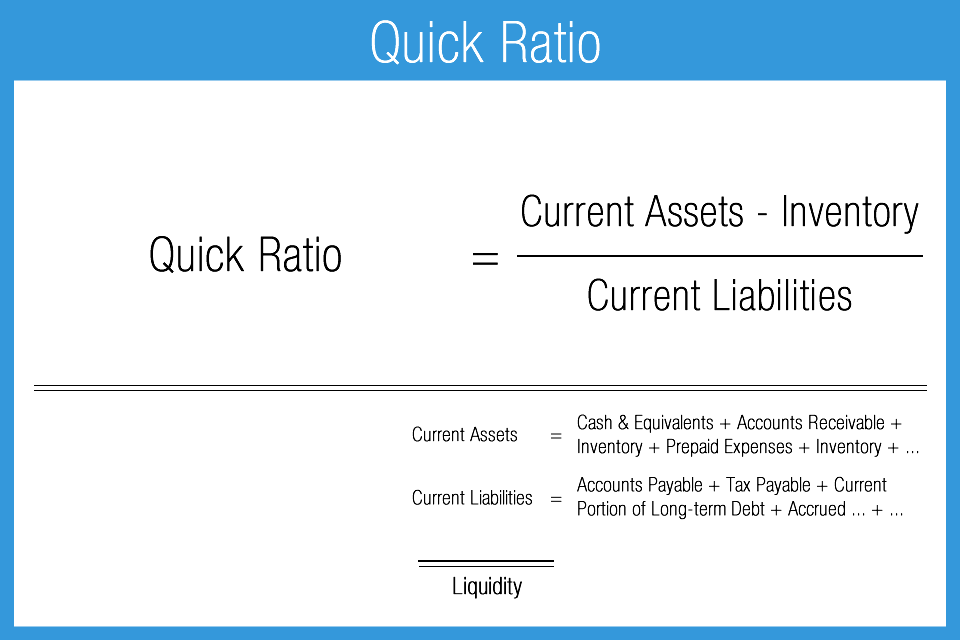

Advanced ratios

I often stress to my students to prepare before you risk your hard-earned money. Too many people are too lazy in this industry to put in the work to be successful. Current assets refers to the sum of all assets that will be used or turned to cash in the next year. Finally, if stock picking is not for you, you could try investing in ETFs or in futures markets. Besides, you should analyze the stock’s Sortino ratio and verify if it has an acceptable risk/reward profile. If you are interested in corporate finance, you may also try our other useful calculators.

How to calculate the current ratio

One fundamental indicator probably won’t rock your trading world. But just because a company doesn’t need money today doesn’t mean it won’t do a financing. It could have a ton of long-term debt maturing in the near future.

Do you own a business?

This is why it is helpful to compare a company’s current ratio to those of similarly-sized businesses within the same industry. Secondly, we must identify the current liabilities, which encompass the company’s debts and obligations due within a year, such as accounts payable and short-term loans. If it’s growing, that can tell investors and traders that the company’s current assets are growing.

Low values for the current ratio (values less than 1) indicate that a firm may have difficulty meeting current obligations. However, an investor should also take note of a company’s operating cash flow in order to get a better sense of its liquidity. A low current ratio can often be supported by a strong operating cash flow. Current liabilities are obligations that are due to be paid within one year.

- After consulting the income statement, Frank determines that his current assets for the year are $150,000, and his current liabilities clock in at $60,000.

- Current ratio is a number which simply tells us the quantity of current assets a business holds in relation to the quantity of current liabilities it is obliged to pay in near future.

- Sometimes these tiny companies only have one or two current asset accounts.

- Ratios in this range indicate that the company has enough current assets to cover its debts, with some wiggle room.

- For instance, imagine Company XYZ, which has a large receivable that is unlikely to be collected or excess inventory that may be obsolete.

- Whether you’re a seasoned pro or a newcomer to the world of investing, grasping the essentials of the Current Ratio is a critical step toward financial acumen.

This is arrived at by dividing current assets by current liabilities. Therefore, applicable to all measures of liquidity, solvency, and default risk, further financial due diligence is necessary to understand the real financial health of our hypothetical company. A lower quick ratio could mean that you’re having liquidity problems, but it could just as easily mean that you’re good at collecting accounts receivable quickly.

A current ratio that is lower than the industry average may indicate a higher risk of distress or default by the company. If a company has a very high current ratio compared accountant the with its peer group, it indicates that management may not be using its assets efficiently. However, if you look at company B now, it has all cash in its current assets.

The operating ratio shows how efficiently a company’s management can generate money from its operating expenses. In other words, can the company live off its operations without resorting to using debt? Here, I’ll explain what a current ratio is and give you an overview of the liquidity ratio family. The volume and frequency of trading activities have high impact on the entities’ working capital position and hence on their current ratio number.

Even within an industry, current ratios can differ between companies. The ideal current ratio is proportional to the operating cycle. Companies with shorter operating cycles, such as retail stores, can survive with a lower current ratio than, say for example, a ship-building company. The current ratio should be compared with standards — which are often based on past performance, industry leaders, and industry average.

A ratio under 1.00 indicates that the company’s debts due in a year or less are greater than its cash or other short-term assets expected to be converted to cash within a year or less. In general, the higher the current ratio, the more capable a company is of paying its obligations because it has a larger proportion of short-term asset value relative to the value of its short-term liabilities. Therefore, the current ratio is like a financial health thermometer for businesses.

Current assets (also called short-term assets) are cash or any other asset that will be converted to cash within one year. You can find them on the balance sheet, alongside all of your business’s other assets. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. In this example, the trend for Company B is negative, meaning the current ratio is decreasing over time. An analyst or investor seeing these numbers would need to investigate further to see what is causing the negative trend. It could be a sign that the company is taking on too much debt or that its cash balance is being depleted, either of which could be a solvency issue if the trend worsens.