Cost of Production Report: Unraveling the Cost of Production Report in Manufacturing

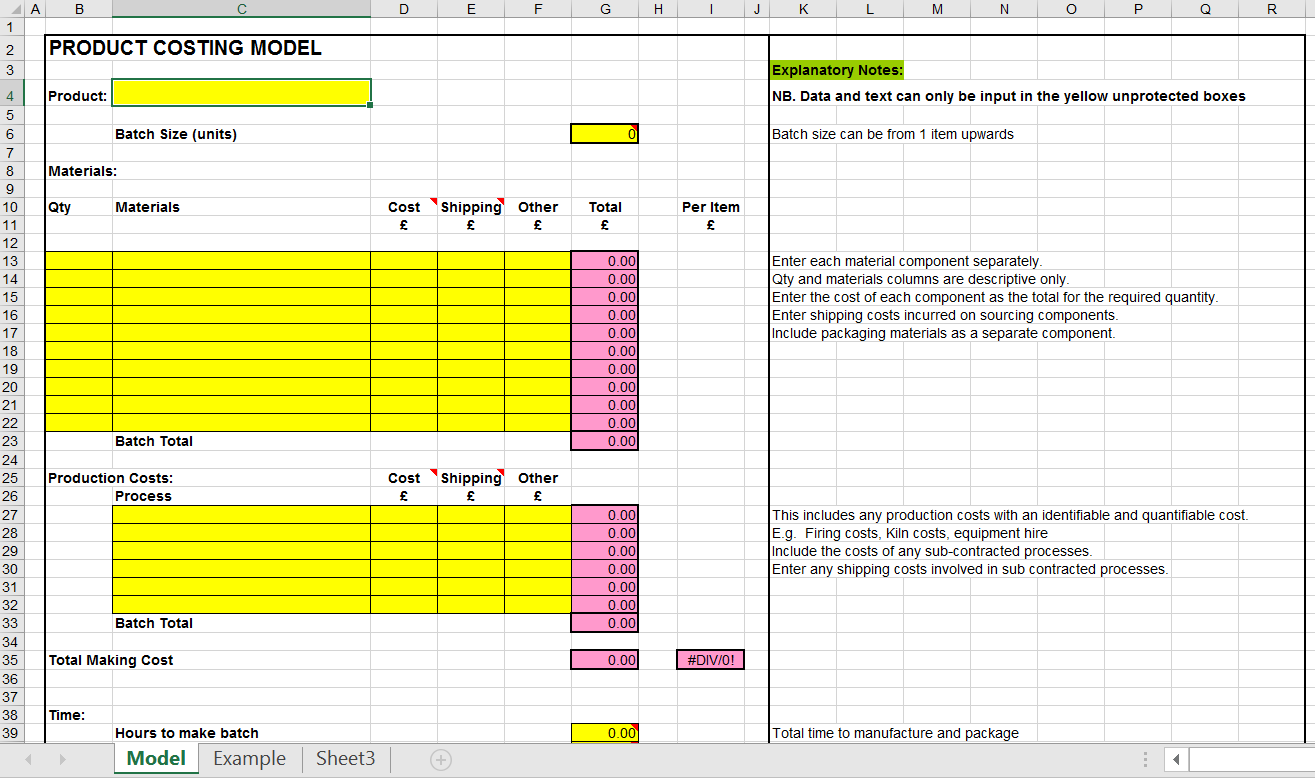

It helps to ensure that the budget is followed, the resources are used efficiently, and the stakeholders are informed of the financial status and performance. In this section, we will explore the basics of cost reporting, such as what it is, why it is important, and how to prepare and present a cost report. We will also discuss some of the challenges and best practices of cost reporting from different perspectives, such as the project manager, the client, the accountant, and the auditor. Finally, we will provide some examples of cost reports and how they can be used to communicate and analyze the cost information. Understanding the key components of a Cost of Production Report is crucial for any manufacturing business aiming to streamline its operations and maximize profitability. This report serves as a financial mirror, reflecting the detailed expenses incurred in the production process.

- The production volume to be manufactured by an organization should be determined by its production budget.

- Allocating manufacturing overhead is a multifaceted process that requires careful consideration of the company’s operations and the products it manufactures.

- In circumstances where the product is flowing in batches like this, FIFO gives us a more accurate per unit cost for both beginning and ending work-in-process inventory.

- In this section, we will discuss some of the best practices for preparing and presenting a cost report, as well as some of the common challenges and pitfalls to avoid.

Analyzing Cost Data

This means presenting the cost data and metrics in a clear, concise, and consistent manner, using tables, charts, graphs, and narratives. The cost report should follow the standards and guidelines of the organization and the industry, as well as the expectations and preferences of the audience. The cost report should also include a summary, an introduction, a body, and a conclusion, as well as a title page, a table of contents, and an appendix.

Is there any other context you can provide?

For example, if costs are going up, the cost of those 750 pie shells in beginning work in process inventory would be less than the cost of the 1,000 pie shells in ending inventory. For a marketing strategist, understanding the cost of production is key to formulating a value proposition. If a product is more expensive to produce but offers unique benefits, marketing can craft messages that justify the premium price. COGS is more than just a number; it’s a multifaceted indicator of a company’s operational effectiveness and financial health. By thoroughly interpreting COGS, businesses can make informed decisions that enhance profitability and competitive advantage.

Step 2 of 3

If the cost report is intended to analyze the cost-effectiveness of a program, then the cost data should include both the inputs and the outputs of the program, such as the resources used and the outcomes achieved. When reporting on production costs it should include whos included in your household all the expenses that have been incurred from manufacturing a product. That means direct costs, such as raw materials and labor, as well as indirect costs, such as rent and overhead. All of these costs are added up to come up with the total production costs.

Successful Cost Reporting Examples

Using a standardized and transparent methodology will help to ensure the consistency, accuracy, and reliability of the cost report, as well as to facilitate the comparison and communication of the results. For example, a standardized methodology may include the use of a common cost breakdown structure, a uniform cost accounting system, and a predefined cost reporting template. For example, consider a car manufacturer that starts with 100 units of raw steel (valued at $50 each) and incurs labor costs of $20 per unit. If 50 units are halfway through the assembly process, the WIP Inventory would include the cost of steel ($50 x 50 units) and half the labor costs ($10 x 50 units), totaling $3,000.

Maintenance Costs

Production downtime refers to the time a factory’s assembly lines aren’t operating. By reducing the downtime, production managers can increase the productivity of their manufacturing efforts. Incorporating these climate costs into material prices could drive innovation in low-carbon production methods and increase the competitiveness of recycling and alternative materials. For example, if aluminium and steel production transitioned entirely to renewable energy sources, their climate-related costs would decrease by 95% and 79%, respectively. Multiply the cost per equivalent unit by the number of equivalent units for each category of units accounted for.

The country’s main Kharg Island export terminal that ships 1.6 mb/d of crude, primarily to China, is a major concern as is the potential spillover to the strategic Strait of Hormuz waterway. For now, oil exports from Iran and neighbouring countries are unaffected but the market remains on tenterhooks, awaiting the next developments in the crisis. At the same time, Libyan crude shipments have resumed, following the hard-won agreement that resolved the political dispute that had disrupted oil exports. On the other hand, the above-normal US hurricane season still has six weeks to go. In circumstances where the product is flowing in batches like this, FIFO gives us a more accurate per unit cost for both beginning and ending work-in-process inventory. This is where equivalent units are different than the normal formula, but only for beginning inventory.

All of our content is based on objective analysis, and the opinions are our own. However it is recommended to use job order costing for more than one product. Process Costing always follows the same process while job-order costing applies to each job separately.